Rental property basis calculator

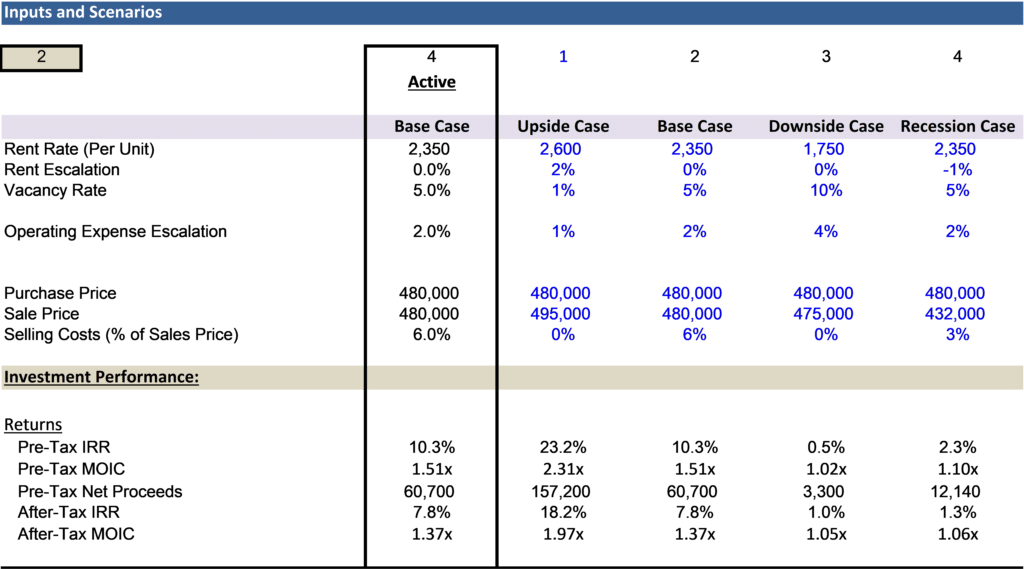

Find the Right Investment Property In Minutes. Start with the original investment in the property.

How To Calculate Adjusted Basis Of Rental Property

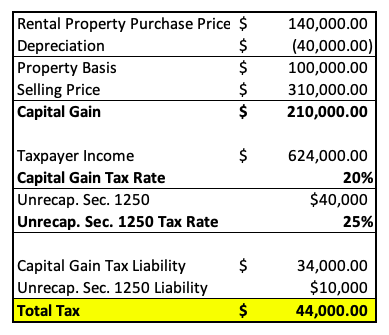

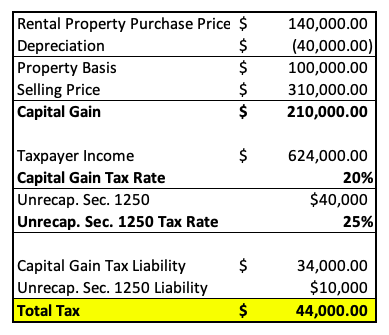

The capital gain is calculated by deducting the adjusted cost basis of the rental property from the net sales price.

. Instead I looked on Zillow and looked at similar homes. You make a 20 down payment and the interest rate is 3. Same Property Rule.

Imagine that you want to purchase a rental property that costs 250000. The basis is the purchase price plus related realtor commissions. 150000 30000 - 25000 155000.

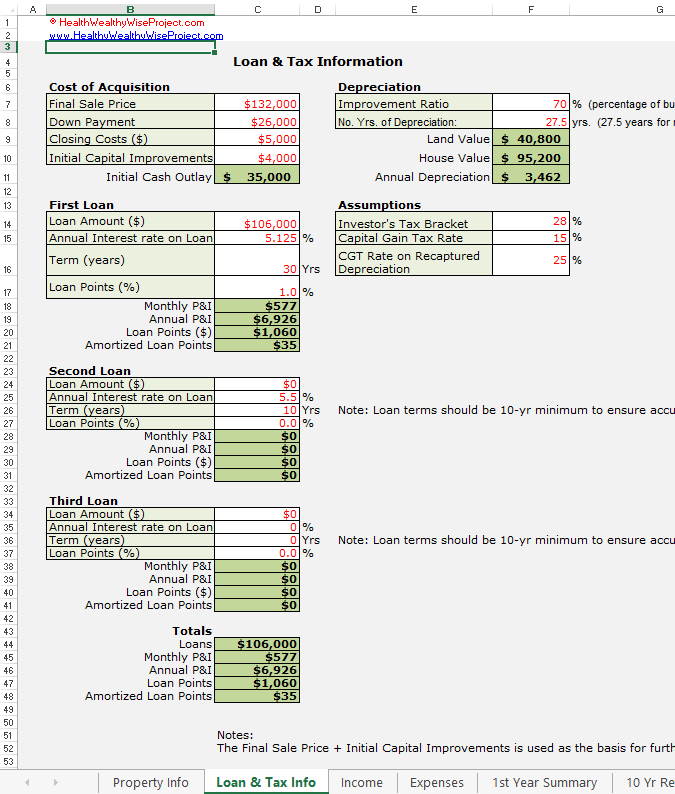

Add the cost of major improvements. Calculate Understand Your Potential Returns. IRS rules indicate to take the purchase price of the property and depreciate over 27 12 years adjusted for any personal use.

Step 6 Calculate gain on sale of rental property. To work out your profit or loss you should treat all receipts and expenses as one business even if youve more than one UK property by. The Rental Property Mortgage Calculator We included a rental property mortgage calculator in the broader rental cash flow calculator above to make it easier to run the numbers if you leverage.

The basis is used to calculate your gain or loss for tax purposes. 250000 purchase price 4500 closing. How to work out your taxable profits.

If your sale price is. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertyÕs useful life. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

Since purchasing the property you have invested 30000 into capital improvements. To find the adjusted basis. The tax rate can vary from 0 to 396 depending on.

1 Rule The gross monthly rental income should be 1 or more of the property purchase price after repairs. In our example letÕs use our existing In our example letÕs use our. The basis is also called the cost basis.

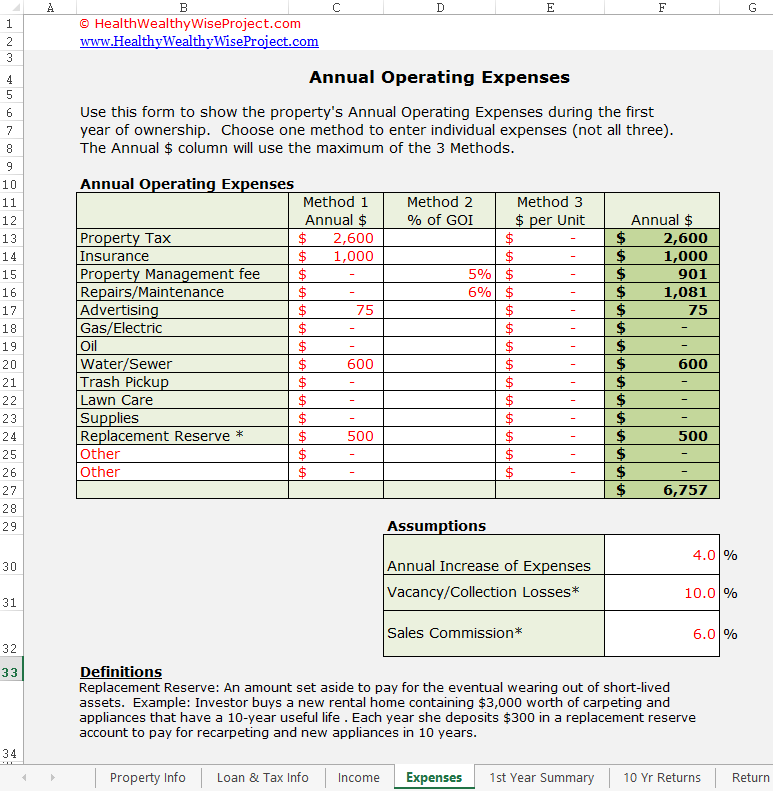

The operating expenses throughout the year. If your taxable income. Adjusted Basis Calculator - Real Estate Investment Equations Formulas Adjusted Basis Equations Calculator Investment Real Estate Property Land Residential Commercial Building Formulas.

Cash profit is how much you will. 165430 net sales price 145207 original cost basis 20223 capital gain The. In 2009 I converted my main property into a rental property.

Compare the fair market. Our calculator in specific performs this simple calculation by taking the cash profit or net gain on the investment and dividing that number by the original cost. The basis is also called the cost.

Regarding basis for depreciation on rental property. Subtract the amount of allowable depreciation and casualty and theft losses. If you spent 500 on repairs and then another 300 on cleaning before listing your rental property for rent your adjusted cost basis will look like this.

I didnt get an appraisal at the time to determine the cost basis. A regulation relating to IRA rollovers stipulating that whenever a financial asset is withdrawn from a retirement account or IRA for the purpose of funding a.

Rental Property Cash Flow Calculator

Rental Property Cash On Cash Return Calculator Invest Four More

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

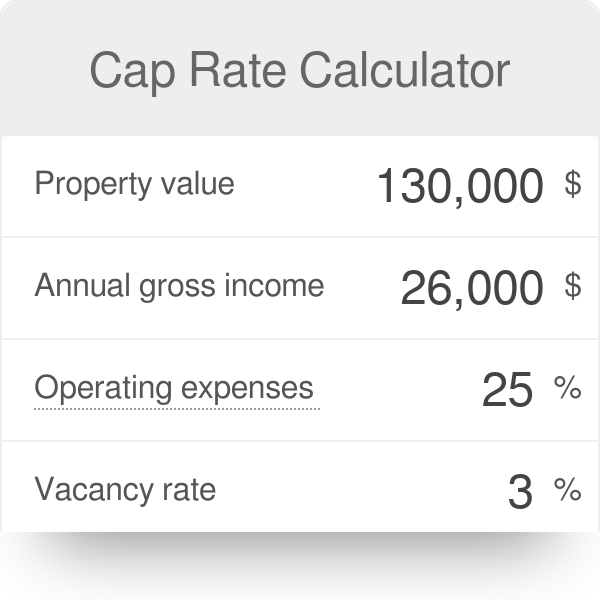

Cap Rate Calculator

Depreciation For Rental Property How To Calculate

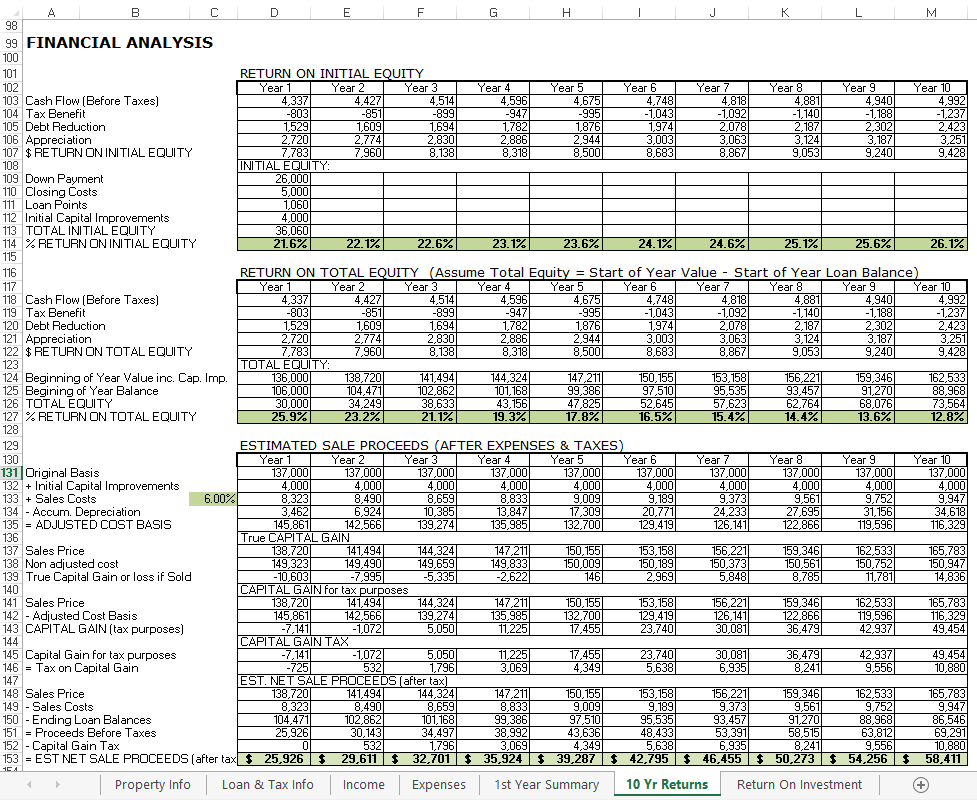

Rental Income Property Analysis Excel Spreadsheet

Converting A Residence To Rental Property

Rental Income Property Analysis Excel Spreadsheet

How To Use Rental Property Depreciation To Your Advantage

Return On Equity Roe Calculator For Real Estate Investing Denver Investment Real Estate

Rental Income Property Analysis Excel Spreadsheet

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator With Formula Nerd Counter

Is Rental Property A Capital Asset And How To Report It Taxhub

Landlord Template Demo Track Rental Property In Excel Youtube

Rental Property Calculator 2022 Casaplorer

Free Rental Property Excel Spreadsheet Start Investing In Real Estate